The GameStop Surge: Redditors and the Reckoning of Financial Markets

Amateur investors on Reddit have challenged public perceptions of the market and the future of investing.

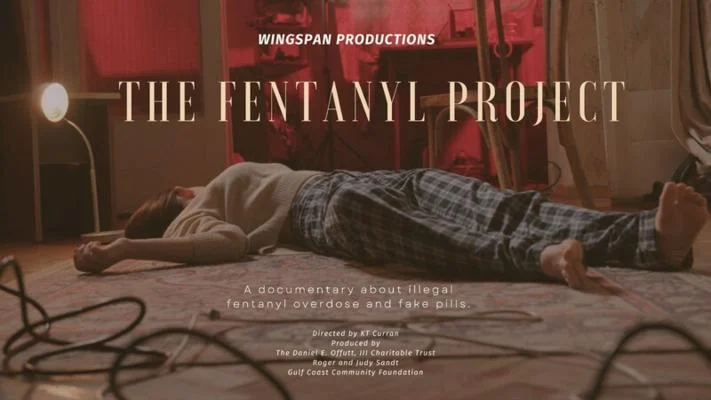

Some might see investing as a game or a meme, but actions in the market can have serious consequences.

February 17, 2021

When imagining what a Wall Street Investor looks like, people imagine brokers in suits and ties staring at screens in stock exchanges. Maybe that’s why no one expected that the current drivers of our financial markets would be ordinary people on their smartphones, altering the course of the stock market with a few clicks on their trading apps.

The stock market allows investors to purchase potential future earnings of a company, or shares, to help a company grow. If the company prospers, the share price goes up and the investors make a profit.

Typically, investors tend to purchase more shares when the market price is low. Consider the case of GameStop, a retail store specializing in electronics and video games, whose stock prices remained fairly low up until recently. Sensing a potentially profitable market, financial brokers began borrowing shares of Game Stop from investors and immediately sold them with the intention of buying them back at a lower price, a lucrative yet risky bet.

This is called “shorting a stock.” While legal, the process feels wrong, as investors want businesses they bet against to fail. However, issues happen when a stock goes higher than the price at which the investors sold the borrowed shares. To give the shares back (to whom they borrowed from), they have to buy them at a higher price, sometimes for massive losses.

While GameStop’s shares were being shorted in this way, the web forum r/wallstreetbets took notice. Users on the site were encouraged to invest in GameStop and the price of the shares shot up due to the reddit-inspired interest. Brokers who had shorted GameStop were forced to buy shares at the much higher price to “give them back” to the lenders they got their shares from.

Investors needed to sell other stocks for the capital and the rest of the market was threatened with ruin as hedge funds divested from other stocks to pay for their GameStop losses. The redditors also drove the share price up by buying stock of other companies that had been shorted, like AMC movie theaters, increasing the losses of the brokers.

To buy their stock, many Redditors had turned to the Robinhood investing app. However, rapid artificial inflation led the app to block the purchase of additional stock not for any nefarious reason, but because they lacked the necessary cash to back purchases of a stock that was climbing higher by the minute. Still, established investors were able buy and sell those stocks using more traditional methods, leading to cries of inequality regarding who gets to invest.

Free markets, but only for the rich who can access them. At least that’s what Congress thinks. Representative Alexandria Ocasio-Cortez (D-NY) and Senator Ted Cruz (R-TX) both condemned the move by Robinhood. Concerns were not only raised that a single app could disable the potential for a small yet significant portion of investors to trade on the markets but whether investing in the markets should be restricted only to the professional trader.

The GameStop surge is almost certainly temporary. Already, the price has trended downwards for several days. Redditors certainly artificially inflated the price beyond the capacity of the business, prompting accusations of market manipulation. But whereas exploiting an entire industry in the world is market manipulation, short selling is one of the methods professional investors use to twist the market to their advantage.

Should the market be manipulated for artificial financial gain? There’s a certain argument that the market should be a forum where people go not just to play financial games with stocks, but to meaningfully invest in the success of a company, hoping it succeeds and earning that profit.

Others claim that the Redditors who invested in GameStop are heroes, attacking the oligarchy of Wall Street traders who manipulate the market at the expense of the little guy and condemning stores like GameStop to failure.

Yet the Redditors aren’t innocent in their actions in the market. Their online forums pushed armchair investors to buy GameStop and coerced people into keeping their stocks as it climbed higher, thus manipulating the stock price to far beyond the actual value of the stock.

Similar to the reckonings after the Great Depression, backlash to market manipulations and wealth inequality last culminated in the “Occupy Wall Street” protest, where protesters controlled Zuccotti Park in New York for several weeks in 2011.

Similar incidents spread across the world soon after. Could this latest market controversy cause similar backlash? If there is a grassroots response, it could lead to major reforms of markets that many across the political and economic spectrum have been demanding.

It’s very rare that a company’s share price would be disconnected from the company’s real world value. With such volatility comes lessons for both amateur or experienced investors. It might be tempting to jump into the market and treat investments like a casino, but in reality, only the most serious and thoughtful investors have any lasting success.

For the new or amateur investor, economists have plenty of tried and true advice. The skyrocketing and falling prices of individual companies are making index funds (or investments in a spread of a certain industry)look more desirable to invest in. Uncertainty should also lead investors to keep a diverse portfolio and invest in different types of stocks.

Though the GameStop surge may soon be forgotten, all the publicity now may lead many to start to think about investing in the stock market. Like other financial anomalies, it is still important to learn from it and become better investors in the complex world of Wall Street.